Has the recovery trend of the real estate market not stopped? The mysterious investor who made a 525% profit returns to Zillow call options

A mysterious investor of Zillow, one of the most visited real estate websites in the United States, seems to have bet on Zillow call options since the end of October 2023. It is estimated that the total profit is about 39 million US dollars. This mysterious investor has also bet part of the profit on the recovery trend of the US real estate market in 2023 continuing in 2024.

It is understood that the call options bought back on October 25 enabled the holders to purchase about 3.4 million shares at a price of 45 US dollars. As the stock price of Zillow soared by about 60% in the last two months of last year, the value of the call options jumped significantly. On Tuesday, after the total value of the options rose by 525%, the buyer seemed to have sold all these options and took back the call options due in May. These call options would allow the buyer to buy back 5.1 million shares at a price of 65 US dollars per share. Data shows that this new transaction of the investor is based on the expectation that the stock price of Zillow will rise further by 12%.

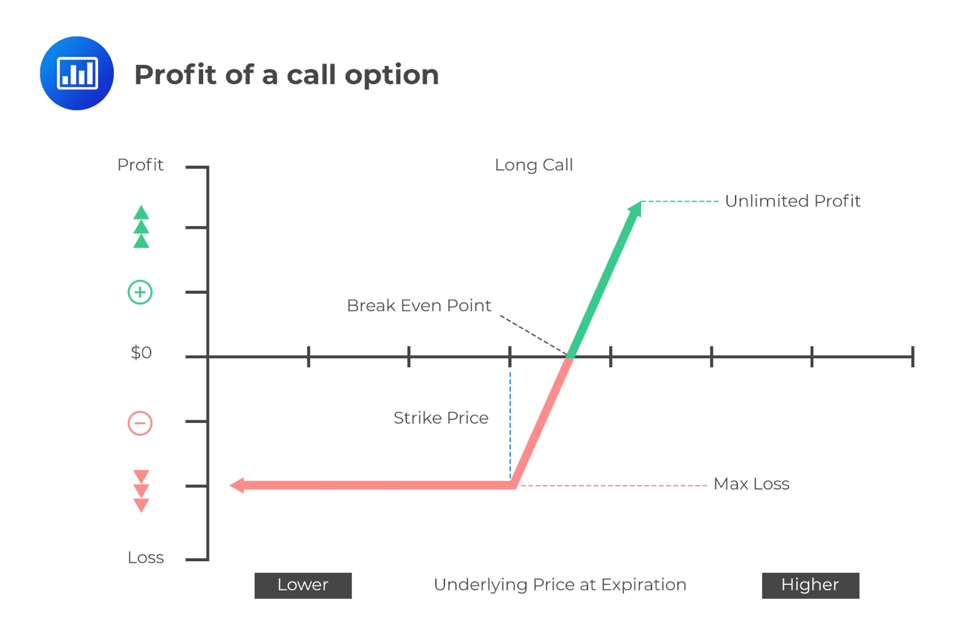

Therefore, the operator of this mysterious transaction originally bought the options at a low price. With the significant rise in the stock price of Zillow, the value of these options increased significantly. After achieving this significant gain, the investor sold the original options and bought new call options again, expecting the stock price of Zillow to continue to rise. This transaction can be called a textbook “option trading strategy”, which obtains high returns by taking advantage of the trends and price fluctuations of the macro market.

In terms of stock prices, since the initial option transaction, the stock price of Zillow has jumped from about 38 US dollars to about 58 US dollars. This is part of the general rebound of the US residential real estate market. The financial market is optimistic that the US mortgage loan rate has peaked and expectations for the Fed to cut interest rates have risen. If the Fed starts to lower the benchmark lending rate in the first half of this year, the mortgage loan rate may fall more rapidly and the purchase scale may increase rapidly.

Statistical data shows that the insufficient supply of houses for sale has led to the continuous rise in US house prices in the second half of 2023. According to the data of the S&P Case-Shiller Home Price Index, the national home price in October 2023 increased by 4.8% compared to October 2022, marking the ninth consecutive month of increase. This increase exceeded the 4% annual growth rate in September, marking the strongest increase in 2023.

Brian Luke, the head of commodities, real estate and digital assets at S&P Dow Jones Indices, said in a statement: “House prices may continue to rise, especially as mortgage rates decline and the Fed moves towards a more accommodative policy stance. Homeowners may see more asset appreciation.”

Chris Murphy, the co-head of derivatives strategy at Susquehanna International Group, said: “The operator of this Zillow option transaction can be described as a big winner.” “Although this investor has made huge profits through options, they still seem optimistic about the future upside potential of the stock.”

Public information shows that Zillow Group is an online real estate transaction company focused on the US real estate field, mainly providing services for buying, selling, renting and financing real estate. It is one of the most visited real estate websites in the United States, providing users with an immediate experience and enabling them to conduct real estate transactions in a transparent and almost seamless manner. Zillow Group combines technology with top-notch services and cooperates with real estate agents, brokerage firms, builders, property management companies and landlords to help them succeed.