The Foreign Investment in Real Property Tax Act (FIRPTA) was established in 1980 to ensure that income tax arising from the transfer of interests in U.S. real estate by foreigners or foreign entities can be deducted. Regarding real estate, foreigners (non-tax residents) or foreign entities must withhold 15% of the transaction amount when selling U.S. real estate interests and submit it to the IRS (Internal Revenue Service of the United States). Therefore, Chinese investors should pay special attention and plan corresponding investment strategies.

The above-mentioned foreign entities mainly refer to foreign companies, foreign partnerships, foreign trusts, and real estates. Real estate interests not only include the direct ownership of typical real estate such as land and houses in the United States but also include equity in U.S. real estate companies. A domestic U.S. company whose total assets exceed 50% of typical real estate such as land and houses in the United States is defined as a “U.S. real estate company”.

The PATH Act of 2015 initiated several tax expansion agencies and new tax laws, which increased the FIRPTA withholding tax rate from the original 10% to 15%. However, the deduction rate of 10% still applies to the sale of properties with a transaction amount of $1 million or less, but the buyer needs to use the house as their primary residence. There is also an exceptional case: if the buyer purchases the real estate as their primary residence and the purchase price does not exceed $300,000, no withholding tax is required.

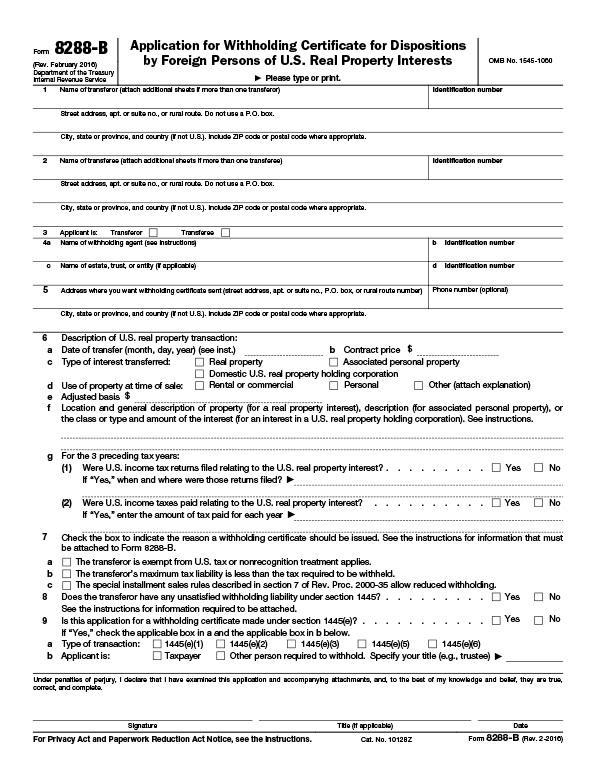

The U.S. tax law requires non-resident foreigners selling U.S. real estate interests to have the withholding tax deducted from the buyer’s payment and must be forwarded to the IRS by the intermediary agency responsible for the transaction within 20 days after the transaction closing date. Later, an application is submitted in the second tax year, and the IRS will uniformly calculate and refund or collect the difference. Or submit an application to reduce the FIRPTA withholding, and the intermediary agency will generally return the calculated remaining amount within 90 days.

If as a buyer, a FIRPTA certificate needs to be signed by the seller, truthfully stating whether they are a foreign individual or entity to prevent tax risks. Because the FIRPTA Act stipulates that the buyer is the withholding agent of the withholding tax (the withholding tax is deducted from the transaction payment paid by the buyer), if the seller does not disclose their true identity, then the buyer will need to bear the tax obligations and related penalties.

If as a seller, because according to the FIRPTA Act, the transfer of equity in a U.S. real estate company also requires the payment of the above withholding tax, it is a more favorable operation method for Chinese investors to use an intermediate holding company established in a third country to indirectly hold the investment structure of the U.S. real estate company.

The above is only a general discussion of the FIRPTA Act. For specific foreign investment in U.S. real estate projects involving U.S. houses, specific analysis is still required, and advice from tax advisors with professional experience should be sought to reduce the risk of a significant increase in investment costs and a decrease in investment returns.