The real estate tax in the United States: Understanding taxation and investment

The real estate tax in the United States is regarded as one of the main sources of fiscal revenue for state and local governments, used to fund projects such as education, infrastructure, and social services. Homebuyers need to pay real estate tax based on the valuation of the property after purchasing it, and this tax is usually required to be paid annually. According to data from the American Tax Lien Association, more than 14 billion US dollars in real estate tax fail to be paid on time each year.

Calculation and impact of real estate tax

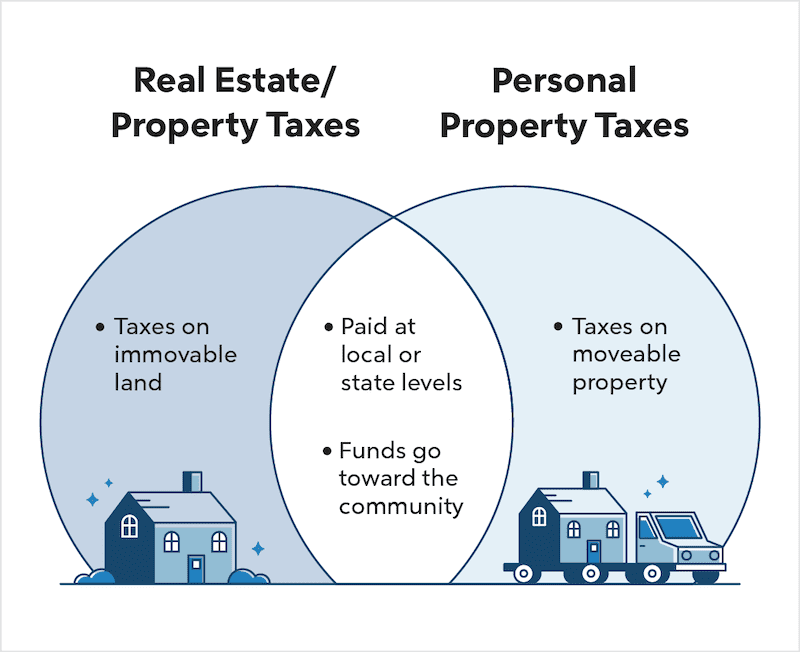

Real estate tax, also known as property tax, refers to a tax levied on real estate or land. The calculation method of the tax varies by region. Usually, local assessors/appraisers value the property and then levy taxes based on the valuation. The property valuation cycle varies in different regions. Some places conduct valuations once a year, while others may do it every few years. The valuation of a house is usually based on the transaction prices of similar properties in the recent period and adjusted considering factors such as building permits and property appreciation.

Tax benefits and real estate investment

However, real estate tax rates and policies vary in each state and local area, which may be affected by local financial needs and policy changes. Some places may offer tax deductions or benefits. For example, the elderly, retired military personnel, or low-income families may enjoy certain deductions. Although real estate tax is a fixed expense, many investors and wealthy individuals still choose to invest in real estate in the United States. This is because the real estate market in the United States has huge potential, properties are expected to appreciate, and rental income can also provide a stable cash flow.

Planning your real estate investment

In conclusion, although real estate tax is an inevitable expense for homebuyers, the real estate market in the United States is still attractive, especially for those seeking investment returns. Homebuyers can rationally plan real estate investment based on personal circumstances and financial strategies.

Common terms on the local property tax bill

You usually see the following English terms on the local property tax bill:

- Market Value: Market value

- Land: Land

- Structures: Buildings

- Assessed Value: Assessed value

- Exemptions: Exemptions/deductions

- Taxable Value: Taxable value

- Total Tax: Total local property tax

Understanding property valuation and tax calculation

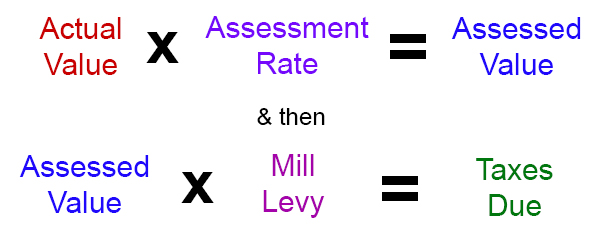

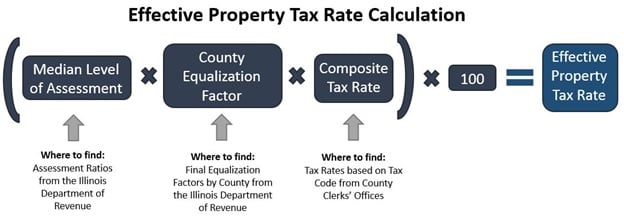

The market value of a house (Market Value) is the price at which the house can be sold in the open market. The value of a house is the sum of the value of the land and the buildings. However, in most places, only a portion of the house price is subject to property tax. After estimating the market value of a house, the tax assessor multiplies it by an assessed ratio (Assessed Ratio) to obtain the assessed value of the house (Assessed Value), which is the portion that actually needs to be taxed. The assessed ratio varies by region and ranges from 0% to 100%. In some areas, there may be some real estate tax deductions and benefits for certain people’s properties. A relatively common one is Homestead Exemption, which can exempt a portion of the local property tax for resident-occupied houses. After deducting the local property tax exemption portion from the assessed value, it is the taxable value (Taxable Value). Multiplying this value by the local property tax rate (usually expressed in one-thousandths, also called Mill Levy), it is the amount of local property tax. In addition, in many places, you may also be able to apply for some Property Tax Credits, which can offset part of the local property tax amount and reduce the property tax to be paid.